Competitor Analysis Frameworks to Master for Product Managers

A beginner's guide for understanding and analyzing competitors.

👋🏻 Hey there, welcome to the #23rd edition of the Product Space Newsletter, where we help you become better at product management.

Understanding your competitors is not just an advantage, it's a necessity. We usually see competitors as threats, but competitors can be valuable assets as well. They set trends sometimes, provide market insights, and ultimately drive innovation that benefits the entire industry.

Competitor analysis is a crucial skill that informs your product strategy and takes it from good to great. By deeply understanding your competitors, you gain strategic insights that can help you refine your marketing approach, expand your customer base, and increase your market share. But how do you conduct an effective competitor analysis?

This is where competitor analysis frameworks come into play. These tools provide structured approaches to gathering, organizing, and interpreting vital information about your competitors. From marketing strategies to product offerings, these frameworks help you visualize the competitive landscape and predict market trends.

In this article, we'll explore seven essential competitor analysis frameworks that every product manager should master. Whether you're a startup looking to disrupt the market or an established player aiming to maintain your edge, these frameworks will equip you with the knowledge to make informed decisions and drive your product to success.

The primary objectives of competitor analysis include:

Understanding market positioning to determine where your product stands relative to competitors.

Identifying opportunities and discover gaps in the market that your product can fill.

Making informed decision by using insights from competitor analysis to make strategic product decisions, such as feature prioritization and market entry strategies.

Types of Competitors To conduct a comprehensive analysis, it's important to consider different types of competitors:

Direct competitors: Businesses offering similar products or services to the same target market (e.g., Apple's iPhone vs. Samsung's Galaxy smartphones).

Indirect competitors: Companies that offer different products but satisfy the same customer need (e.g., Uber vs. public transportation).

Potential competitors: Emerging companies or products that could enter your market in the future (e.g., startups innovating in your market space).

Key Competitor Analysis Frameworks

1. SWOT Analysis -

It is a simple yet powerful framework for evaluating a company's Strengths, Weaknesses, Opportunities, and Threats. It provides a structured approach to assessing both internal and external factors affecting a competitor's position in the market.

How to use:

Strengths: Identify what the competitor does well. This could include brand recognition, unique features, or strong partnerships.

Weaknesses: Pinpoint areas where the competitor falls short, such as poor customer service or outdated technology.

Opportunities: Look for external factors that could benefit the competitor, like emerging markets or new technologies.

Threats: Consider external challenges that could harm the competitor's position, such as changing regulations or new entrants in the market.

Best practices:

Focus on actionable insights. Don't just list attributes, consider how each point could impact your product strategy.

Use concrete data to back up your analysis with market research, customer feedback, and quantitative metrics.

Markets change quickly, so update your SWOT analysis periodically to stay current.

2. Porter’s Five Forces

It’s a framework for analyzing the competitive forces that shape an industry. It helps to understand the dynamics that determine the intensity of competition and profitability.

How to use:

Threat of new entrants: Assess how easily new competitors can enter the market. Consider factors like entry barriers, capital requirements, and regulations.

Bargaining power of suppliers: Evaluate how much control suppliers have over prices and terms. This affects costs and availability of resources.

Bargaining power of buyers: Determine how much influence customers have on prices and product features.

Threat of substitutes: Identify alternative products or services that could fulfill the same customer needs.

Industry rivalry: Analyze the intensity of competition within the industry, considering factors like market growth rate and differentiation.

For example, let's consider how Spotify might use Porter's Five Forces:

Threat of new entrants: Medium (high capital requirements, but low switching costs for users)

Bargaining power of suppliers: High (music labels control content)

Bargaining power of buyers: Medium (many choices, but Spotify has a large user base)

Threat of substitutes: High (YouTube, radio, personal music collections)

Industry rivalry: High (competition from Apple Music, Amazon Music, etc.)

This analysis might lead Spotify to focus on exclusive content deals, improve user experience, and diversify into podcasts to differentiate from competitors and reduce dependence on music labels.

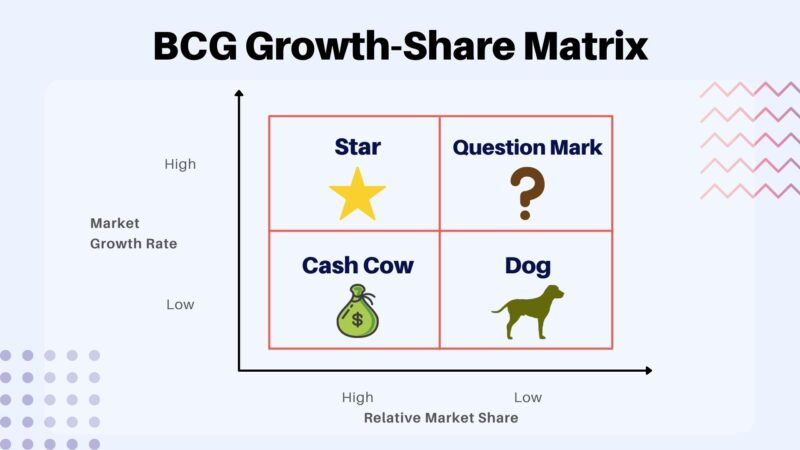

3. Growth-Share Matrix (aka BCG Matrix)

The Boston Consulting Group (BCG) Matrix is a framework that helps companies analyze their product portfolio or competitors' products based on market growth rate and relative market share. It categorizes products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs.

Application in Product Portfolio Management:

Stars: High growth, high market share. These products require significant investment but offer high returns.

Cash Cows: Low growth, high market share. These generate steady cash flow with minimal investment.

Question Marks: High growth, low market share. These have potential but require careful evaluation.

Dogs: Low growth, low market share. These may need to be divested or repositioned.

To apply this to competitor analysis:

Identify the market growth rate for each product category.

Estimate the relative market share of competitors' products.

Plot competitors' products on the matrix.

Analyze the distribution to understand their portfolio strategy.

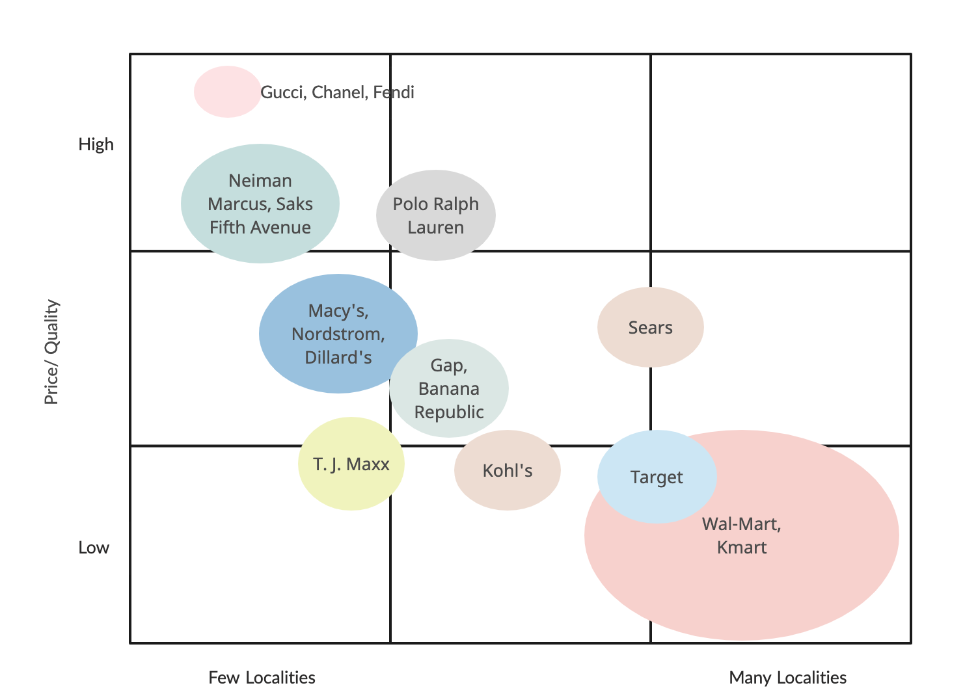

4. Perceptual Mapping

Perceptual mapping is a visual technique used to understand how customers perceive different products or brands in relation to key attributes. It is particularly useful for positioning and differentiation strategies.

How to Create a Perceptual Map:

Identify two key attributes that are important to customers (e.g., price vs. quality).

Create a two-dimensional graph with these attributes as axes.

Plot your product and competitors' products on the graph based on customer perceptions.

Analyze the positioning of products relative to each other.

For example, a smartphone manufacturer creates a perceptual map with "Price" on the x-axis and "Innovation" on the y-axis. They find that:

Their product is perceived as moderately priced with average innovation.

Competitor A is seen as highly innovative but expensive.

Competitor B is perceived as budget-friendly but less innovative.

This insight could lead the company to either:

a) Emphasize their balance of price and innovation in marketing.

b) Invest in R&D to move up the innovation axis and compete more directly with Competitor A.

5. Competitor Feature Analysis

This framework involves systematically comparing your product's features against those of competitors to identify gaps, opportunities, and areas for differentiation.

How to use:

List all key features of your product and competitors' products.

Rate each feature on factors like functionality, user experience, and uniqueness.

Identify gaps where competitors excel or where there's an opportunity to differentiate.

Prioritize features for development or improvement based on this analysis.

6. Strategic Group Analysis

Strategic Group Analysis is a method for categorizing companies within an industry into groups based on similar strategies or business models. It helps in understanding the competitive dynamics within each group.

How to Use:

Identify the key strategic dimensions (e.g., price, quality, distribution channels) that differentiate companies in your industry.

Group companies with similar strategies together.

Analyze the competitive behavior within each group to identify mobility barriers and opportunities for differentiation.

For example, in the ride-sharing industry, a Strategic Group Analysis might reveal:

Group A: Global players with diverse services (e.g., Uber, Grab)

Group B: Regional players focused on ride-sharing (e.g., Lyft, Ola)

Group C: Niche players (e.g., luxury ride services)

This analysis can help identify mobility barriers between groups, understand the intensity of competition within each group, and find opportunities for differentiation or new market entry.

7. Customer Journey Mapping

While typically used for understanding customer experiences, Customer Journey Mapping can be adapted for competitor analysis by mapping out how customers interact with competitors' products.

How to use:

Identify key stages in the customer journey (awareness, consideration, purchase, use, support).

Map out touchpoints where customers interact with competitors' products at each stage.

Identify pain points where customers face challenges or frustrations and moments of delight in the competitor's customer journey.

Compare this to your own customer journey to find areas for improvement or differentiation.

For example, an e-commerce company can map out the customer journey for a major competitor and discovers:

The competitor excels in the awareness stage with strong social media presence.

There are pain points in the purchase stage due to a complicated checkout process.

Post-purchase support is a weakness for the competitor.

Based on this analysis, it can decides to streamline its own checkout process and invest in superior customer support to differentiate themselves.

Gathering Competitive Intelligence

Effective competitor analysis relies on accurate and up-to-date information. Competitor data can be gathered from a variety of sources:

Primary Sources: Direct observations, customer interviews and surveys, sales team feedback, interviews with industry experts.

Secondary Sources: Competitor websites and marketing materials, customer reviews and forums, social media, industry reports, financial statements.

Tools for Competitor Analysis:

Several tools can aid in gathering and analyzing competitive data:

SEMrush For analyzing competitors' online presence, including traffic and keyword strategies.

Ahrefs For understanding competitors' backlink profiles and SEO strategies.

SimilarWeb For benchmarking traffic, engagement, and audience metrics across competitor websites.

Key Takeaways:

Competitor analysis is not a one-time exercise but an ongoing process. Regularly updating your competitive intelligence and revisiting your analyses will help you stay ahead of market trends and make informed decisions for your product strategy.

As you apply these frameworks in your role, focus on extracting actionable insights that can drive your product forward. Whether it's identifying a new market opportunity, refining your value proposition, or prioritizing product features, competitor analysis should ultimately contribute to creating better products that meet customer needs and stand out in the market.

With this you'll be better equipped to navigate challenges, seize opportunities, and lead your product to success in an increasingly competitive landscape.

That’s a wrap for today!

Do you have a question or a handy tip to share about Competitor Analysis? We’d love to hear from you!

Share in the comments below or reply to this email.

Until next time, keep innovating, keep iterating, and above all, keep being awesome.

Cheers!

Product Space